Movements in the gold price are often misunderstood. Many interpret rising prices as gold “appreciating.” In reality, the movement typically reflects the erosion of the purchasing power of fiat currencies.

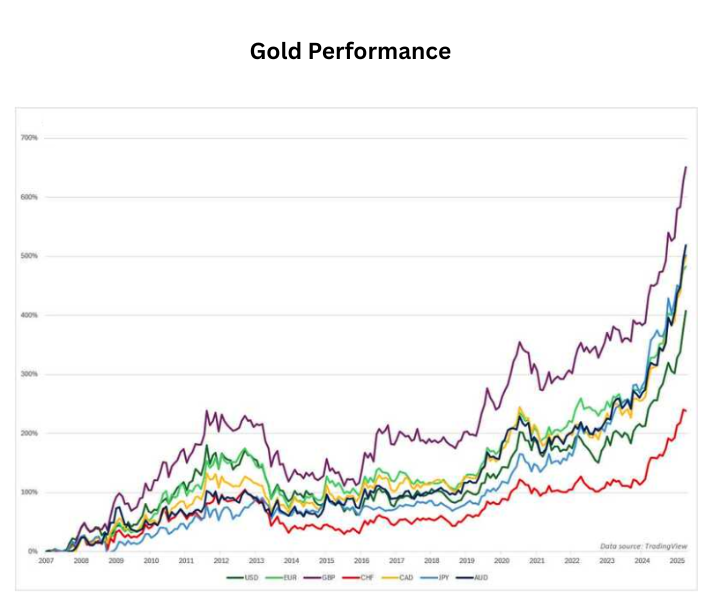

Gold Performance Across Major Currencies

Since 2007, gold has delivered substantial gains when measured against leading global currencies, including the U.S. dollar, the euro, the British pound, the Swiss franc, the Canadian dollar, the Japanese yen, and the Australian dollar. In nearly all cases, performance exceeds 400%, with increases ranging from 238% in Swiss francs to 651% in British pounds.

The data confirm that gold itself remains unchanged in nature. Currencies are weakening.

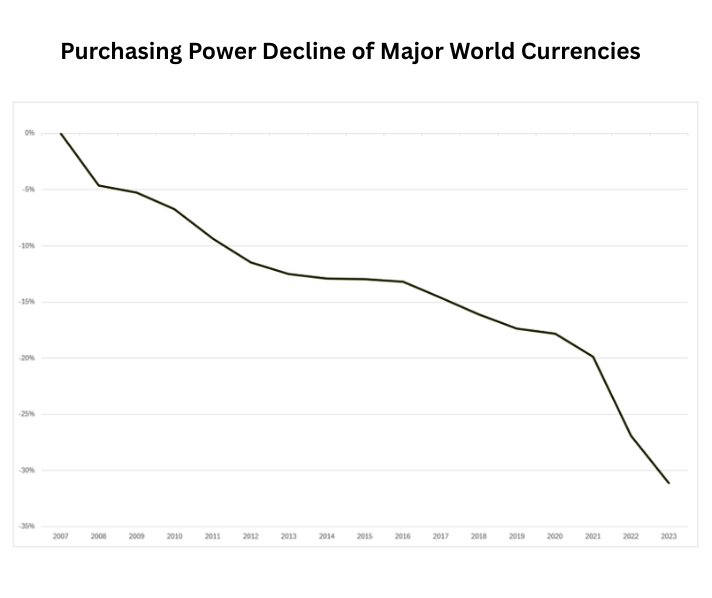

Currency Purchasing Power Against Gold

When currencies are measured against gold, the long-term decline becomes clearer. Since 2007, these major currencies have lost close to 80% of their purchasing power relative to gold. The Swiss franc has fallen by around 70%, while the British pound has dropped by approximately 87%.

Gold remains the most reliable yardstick of monetary value. For over 6,000 years, it has served as both a medium of exchange and a store of wealth. Although removed from the global monetary system in the 1970s, inflationary pressures and financial instability continue to reinforce its relevance.

CPI as a Secondary Benchmark

Consumer Price Index (CPI) data broadly support this trend, though they suggest smaller declines. Since 2007, the examined currencies have lost an average of 31% of their purchasing power, based on CPI calculations. The difference between the 80% decline implied by gold and the 31% decline measured by CPI suggests that official inflation data may understate the true extent of currency debasement.

Sharpest losses occurred between 2007 and 2012 and again from 2020 to 2023. Both periods were characterized by large-scale monetary expansion in response to economic downturns.

Inflation and Monetary Expansion

Inflation is often attributed to wars, supply shocks, or energy crises. Such events may drive short-term price increases, but the underlying cause of persistent inflation is monetary expansion. As Milton Friedman stated, “Inflation is always and everywhere a monetary phenomenon.”

Since 2007, global M2 money supply has risen more than 200%, increasing from 38 trillion dollars to 111 trillion dollars. This expansion has diluted the value of fiat currency and supported the advance of gold.

The alignment between gold’s price trajectory and money supply growth highlights its effectiveness as a hedge against monetary debasement.

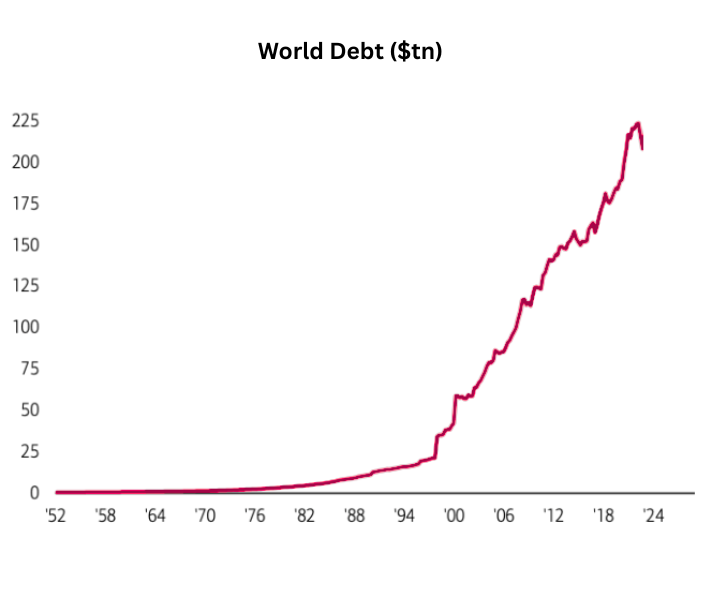

Fiat Systems and the Debt Challenge

The steady decline in purchasing power is a structural feature of fiat regimes. Since abandoning the gold standard in 1971, governments and central banks have been able to expand the money supply without restraint. This flexibility has fueled inflation and repeated episodes of instability.

Global debt has compounded these challenges. Since the late 1990s, debt has expanded more than tenfold, reaching 224 trillion dollars. Such debt levels limit fiscal options and increase dependence on further monetary expansion. The result is a cycle of currency devaluation that reinforces gold’s value.

Conclusion

Gold’s long-term gains across global currencies are best understood as evidence of fiat money’s decline rather than an appreciation of gold itself. Inflation, driven by monetary expansion and compounded by rising debt, remains the central cause.

As long as fiat currency regimes persist, purchasing power erosion is inevitable. Within this environment, gold continues to serve as a proven hedge and the most enduring store of value.