Invest in Gold Coins

Showing all 16 results

Gold coins offer an exciting and practical way to invest in precious metals, combining financial security, aesthetic beauty, and collectible value. Whether you’re an experienced investor or just starting out, gold coins provide a tangible asset that protects your wealth, acts as a shield against inflation, and offers long-term value.

Why Choose Gold Coins for Investment?

Global Acceptance

- Gold coins are universally recognised and highly liquid, making them easy to sell or trade worldwide.

Flexible Investment Sizes

- Available in denominations from 1/20 oz to 2 oz, gold coins cater to a wide range of budgets and goals.

Simple Authentication

- Coins minted by governments or reputable mints feature standardised designs and security features, reducing counterfeiting risks.

Collectible Value

- Some coins gain additional value over time due to their rarity, historic significance, or limited mintage.

Benefits of Investing in Physical Gold

Wealth Preservation

- Gold holds its value independently of government policies or economic downturns, offering true financial security.

Portfolio Diversification

- Gold often moves inversely to stocks and bonds, helping to balance your investment portfolio and reduce risk.

Inflation Protection

- As living costs rise and currencies weaken, gold typically maintains or increases in value, safeguarding purchasing power.

Safe Haven Asset

- During geopolitical tensions or financial crises, gold demand typically rises, further enhancing its value.

High Liquidity

- Gold coins, bars, and jewellery are widely accepted and easily converted into cash when needed.

Popular Gold Coins to Consider

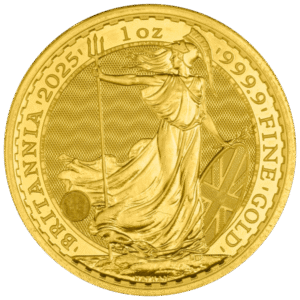

British Gold Britannia

- Struck by The Royal Mint, featuring the image of Britannia and crafted from 99.99% pure gold.

South African Krugerrand

- The world’s first modern bullion coin, containing 91.67% gold, and renowned for its global recognition.

Canadian Gold Maple Leaf

- Issued by the Royal Canadian Mint with 99.99% purity, featuring advanced security elements and a national maple leaf design.

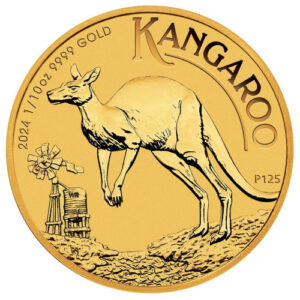

Australian Gold Kangaroo

- Produced by the Perth Mint, featuring annually changing kangaroo designs, minted in 99.99% pure gold.

American Gold Eagle

- A classic US bullion coin featuring Lady Liberty and the bald eagle, made from 91.67% pure gold.

Vienna Philharmonic

- Austria’s contribution to the gold market, offering 99.99% pure gold and elegant orchestral imagery.

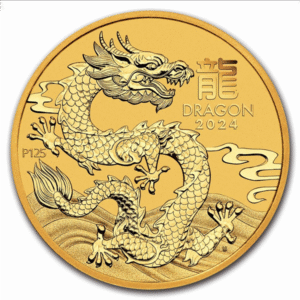

Chinese Gold Panda

- Featuring a new panda design every year, crafted from 99.9% or 99.99% pure gold.

American Buffalo

- The first 99.99% pure gold coin issued by the United States Mint, featuring the American bison.

Gold Coins vs. Gold Bars: Key Differences

| Aspect | Gold Coins | Gold Bars |

|---|---|---|

| Pricing | Slightly higher premiums due to design and collectibility | Lower premiums, priced closer to spot value |

| Purity | Varies (91.67%–99.99%) | Typically at least 99.95% purity |

| Collectibility | Often collectible, with potential numismatic value | Primarily valued for metal content |

| Sizes | Smaller sizes, flexible for any budget | Larger bars ideal for bulk investment |

| Liquidity | Easier to sell in smaller quantities | Larger bars may be harder to liquidate |

Begin Your Gold Investment Journey

Gold coins provide a versatile, secure, and globally recognised way to build and protect your wealth. Whether you prioritise long-term security, portfolio diversification, or collectible value, gold coins are a time-tested choice.

Start by using Metals Radar’s comparison tool to find the best prices from reputable gold dealers, ensuring you maximise the value of every dollar you invest.