Investing in Gold Bars

Showing all 16 results

Gold bars, often referred to as bullion or ingots, are a popular investment choice for individuals looking to secure their wealth in physical form. These bars contain a minimum of 99.5% pure gold, ensuring they meet high-quality standards. Produced by both private and state-run mints, they are subject to rigorous regulations that guarantee their authenticity and purity. This ensures that investors receive genuine, high-grade gold with each purchase.

Available in a range of sizes, from small 1 oz to large 1 kg bars, investors can select a size that aligns with their budget and investment goals. Smaller bars are usually minted with a smooth, polished finish, while larger ones are cast, giving them a more rugged appearance. This flexibility allows individuals to invest according to their preferences, whether they prioritise aesthetics or are looking to purchase in bulk.

Why Opt for Gold Bars?

When investing in gold, investors often choose between bars and coins. Here’s why gold bars might be the preferred option for many:

- Cost Efficiency: Gold bars generally carry lower premiums over the market spot price than coins or jewellery, making them a more cost-effective way to acquire gold.

- Compact and Convenient: With their uniform shape, gold bars are easy to store and handle, making them a practical investment option for those who value space-saving solutions.

- Ideal for Larger Investments: For those looking to purchase significant quantities of gold in one transaction, bars provide a straightforward way to achieve this without needing to buy multiple smaller items.

Key Benefits of Investing in Gold

Gold has long been viewed as a safe haven and a reliable store of value. Investing in gold bars, in particular, offers several important advantages:

- Diversification of Portfolio: Gold typically behaves differently from traditional financial assets like stocks and bonds, making it an excellent tool for reducing risk, particularly in times of market volatility.

- Long-Term Wealth Preservation: Unlike paper currencies, which can lose value over time, gold retains its intrinsic worth. It is a solid means of safeguarding wealth across generations.

- Security During Economic Uncertainty: Gold has always been in demand during times of crisis, whether due to economic instability, political upheaval, or inflation. Gold bars can offer a sense of financial security when other assets may be in jeopardy.

- High Liquidity: Physical gold, whether in bars, coins, or jewellery, is easily traded globally, providing investors with ample opportunities to liquidate their holdings.

- Inflation Hedge: As inflation erodes the value of currency, gold often maintains or even appreciates in value, protecting investors’ purchasing power.

Recommended Gold Bars to Consider

When purchasing gold bars, it’s crucial to select reputable manufacturers known for producing high-quality, authentic gold. Here are some top options available for UK investors:

- PAMP Suisse: Renowned for its premium-quality gold bars, PAMP Suisse offers bars with 999.9 purity. Their range includes options from 1 oz to 1 kg, making it suitable for various investment needs. The Lady Fortuna bar is particularly popular, along with Multigram bars, which can be divided into smaller units, and themed collections like the Lunar Legends.

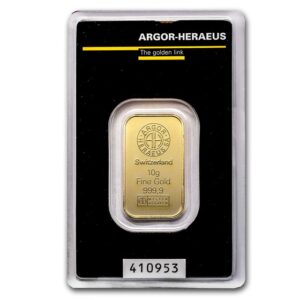

- Argor-Heraeus: A prestigious Swiss refinery, Argor-Heraeus produces gold bars in both minted and cast forms. Their Kinebar series incorporates advanced holographic technology for added security. These bars come in tamper-evident packaging, ensuring their authenticity.

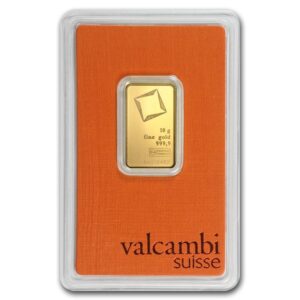

- Valcambi: As one of the largest gold refineries in the world, Valcambi offers a range of gold bars, including the innovative CombiBar® series. This series allows investors to divide their bars into smaller portions, providing flexibility and liquidity. Their products are highly regarded for their elegant design and premium quality.

- Royal Mint and Sovereign Options: The UK’s Royal Mint, along with other government-backed mints, produces gold bars that are trusted for their security and resale value. These bars offer both quality and peace of mind, ensuring your investment is safe.

Important Considerations When Purchasing Gold Bars

Before making a purchase, there are a few essential factors to consider to ensure you’re getting the best value:

- Purity: Always opt for bars with at least 99.5% purity, though 999.9 purity is often the standard for the highest-quality gold.

- Size and Liquidity: While larger bars may offer better value for bulk purchases, they can be less liquid. Smaller bars or divisible options like CombiBars® may be preferable for those seeking flexibility.

- Source and Reputation: Choose reputable manufacturers or mints to ensure you’re purchasing a product that can be easily resold or traded.

- Certification and Packaging: Make sure your gold bar is accompanied by a certificate of authenticity and packaged securely to protect it from damage.

- Price Comparison: The price of gold bars can vary based on size, purity, and the current spot price. It’s essential to shop around and use a trusted comparison tool to ensure you get the best deal.

Buying Gold Bars in the UK

Gold is a globally recognised asset, and investing in gold bars is a smart way to diversify and safeguard your wealth. To find the best prices and ensure you’re buying from a trusted source, consider using a comparison service that lists deals from reputable UK dealers. This approach can help you secure competitive pricing without compromising on quality.