Investing in Silver Coins

Showing all 9 results

Silver coins, typically made from high-purity silver (90% to 99.9%), are a popular choice for investors in the UAE and globally. These coins are often minted by government institutions but can also come from reputable private mints.

Government-backed silver coins not only serve as legal tender in their issuing countries but also carry a premium value due to their silver content and collectability.

If you are considering expanding your precious metals portfolio in the Emirates, here’s why silver coins could be a smart addition.

Why Choose Silver Coins for Investment?

When investing in silver, you typically have two main options: silver coins and silver bars.

But why might coins be the preferred choice? Here are key reasons:

- Variety of Sizes:

Silver coins are available in different sizes, from 1/10 oz to 2 oz and beyond, offering flexibility for every investment budget. - Ease of Liquidity:

Coins are easier to sell in small amounts compared to larger bars, providing greater flexibility if you ever need to liquidate part of your holdings. - Numismatic Value:

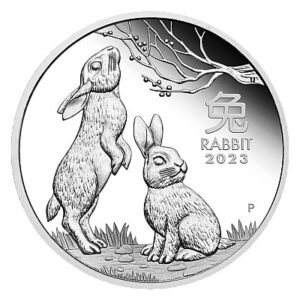

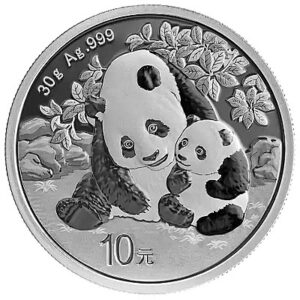

Certain coins gain extra value over time due to rarity or historical significance, enhancing their investment appeal. - Artistic Designs:

Silver coins often feature intricate designs unique to their minting year, making them attractive to both investors and collectors.

Benefits of Investing in Silver

While gold is a traditional choice, silver offers distinct advantages:

- Tangible Asset:

Physical silver provides direct ownership, independent of financial institutions. - Affordable Investment:

Silver is a more accessible entry point compared to gold, ideal for diversifying portfolios without significant upfront cost. - Inflation Hedge:

Silver has historically preserved value during periods of rising inflation, protecting purchasing power. - Industrial Demand:

Silver’s extensive use in electronics, solar energy, and healthcare sustains its long-term demand. - Finite Supply:

Unlike paper currency, silver is a limited resource, supporting its value over time. - Potential for Growth:

Current gold-to-silver ratios suggest that silver may be undervalued, offering the potential for strong future returns. - Portfolio Diversification:

Silver acts as a stabiliser, balancing risk alongside traditional investments such as stocks and bonds.

To maximise your investment, Metals Radar offers a price comparison tool, helping you find the best offers from trusted dealers.

Top Silver Coins for UAE Investors

If you’re looking to purchase silver coins, consider these globally recognised options:

- American Silver Eagle:

Globally trusted, featuring Lady Liberty and the American bald eagle. Highly liquid and secure. - Canadian Silver Maple Leaf:

Produced by the Royal Canadian Mint, known for .9999 purity and advanced security features. - Vienna Philharmonic Silver Coin:

A European favourite, depicting Vienna’s renowned Musikverein Concert Hall and musical instruments. - Silver Krugerrand:

Inspired by the classic South African gold Krugerrand, offering strong global recognition. - Silver Britannia:

Struck by The Royal Mint, the Britannia offers .9999 purity and state-of-the-art anti-counterfeiting measures, ideal for UAE investors seeking both security and collectability. - Australian Silver Kangaroo:

Produced by the Perth Mint, known for its exceptional purity and innovative security elements like micro-laser engravings.

Buying Silver Coins in the UAE

For UAE investors, purchasing silver coins offers a reliable path to wealth preservation, diversification, and protection against inflation.

Beyond their monetary worth, silver coins also carry artistic and historical significance, enhancing their value over time.

When you’re ready to invest, Metals Radar’s comparison tool can help you identify the best deals from trusted dealers, ensuring you make informed decisions and maximise your investment in physical silver.