Invest in Silver Investment

Showing all 12 results

Silver has long been admired for its elegance and versatility, making it a popular choice among discerning investors. Beyond its beauty, silver plays a crucial role in a variety of industries, providing a reliable hedge against economic uncertainties and inflation. Whether you are diversifying your existing portfolio or beginning your investment journey, silver remains a timeless and trustworthy option worth considering.

Why Silver is a Wise Investment

Investing in physical silver offers many advantages:

Tangible Asset:

Unlike stocks or bonds, silver is a physical asset you can securely store, giving investors in the UAE peace of mind and direct ownership.

Inflation Protection:

Like gold, silver is often used as a hedge against inflation. Its value tends to move opposite to fiat currencies and stock markets, helping protect wealth during turbulent times.

Cost-Effective:

Silver offers many of the same benefits as gold but at a more accessible price point, making it an attractive option for a broader range of investors.

Limited Supply and Strong Demand:

Silver is a finite resource. With growing demand and limited new supply, it remains a sensible long-term investment.

Growing Industrial Demand:

Silver’s essential use in electronics, renewable energy, and healthcare industries continues to drive its value.

Potential for High Returns:

Due to silver’s smaller market size compared to gold, price movements can be more volatile, offering opportunities for substantial gains.

Undervalued Opportunity:

Given the current gold-to-silver ratio, many experts believe silver is undervalued, making this an ideal time to invest.

Diversification:

Adding silver to your investment strategy helps spread risk and provides balance against market volatility.

How to Start Investing in Silver

The most common way to invest in physical silver is through bars or coins. Both options offer distinct benefits depending on your investment goals and budget.

Let’s explore them further:

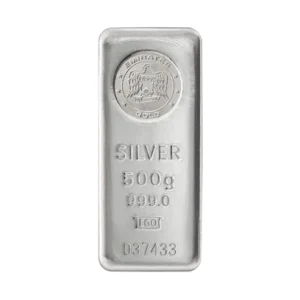

Silver Bars

Silver bars are produced with high purity, typically 99.9% or higher, and come in a variety of sizes—from 1-ounce bars up to 1,000-ounce bars, catering to different investment levels.

Bars from mints like the Royal Mint and PAMP Suisse are stamped with key details:

- Weight

- Purity

- Serial number

- Manufacturer’s mark

Pros of Silver Bars:

- Direct Ownership: Full control over your asset.

- Lower Premiums: Generally cheaper than coins relative to silver’s market price.

- High Purity: Almost pure silver content.

- Transparent Pricing: Closely follows the spot silver price.

Cons of Silver Bars:

- Price Volatility: Silver prices can fluctuate with economic or geopolitical events.

- Limited Liquidity for Large Bars: Selling larger bars can sometimes be less flexible.

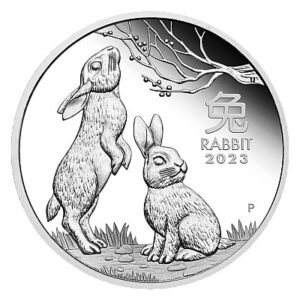

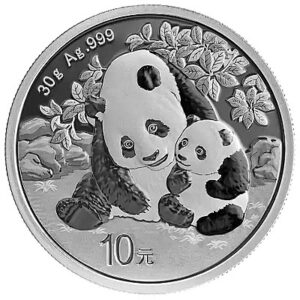

Silver Coins

Silver coins are typically minted with purities ranging from 90% to 99.9%, produced by reputable government and private mints. Popular examples include the British Silver Britannia and the Australian Silver Kangaroo.

Pros of Silver Coins:

- Physical Ownership: Like bars, but often easier to handle and trade.

- Collectible Potential: Some coins gain value over time due to rarity or design.

- Variety of Sizes: Convenient for flexible investing.

- Aesthetic Appeal: Attractive designs can add collector value.

Cons of Silver Coins:

- Higher Premiums: Cost more above spot price compared to bars.

- Market Sensitivity: Priced both on silver content and collectible demand.

Silver Bars vs. Silver Coins: Quick Comparison

| Aspect | Silver Bars | Silver Coins |

|---|---|---|

| Premiums | Lower premiums | Higher premiums |

| Purity | Usually higher (99.9%+) | 90%–99.9% |

| Liquidity | Lower for larger bars | Higher, easier to sell smaller units |

| Collectible Value | Minimal | Possible appreciation |

| Storage | Bulk-efficient | Easier for small investments |

Other Ways to Invest in Silver

If you prefer alternatives to physical ownership, there are other options:

- Silver Jewellery: Stylish but lower investment-grade purity.

- Mining Stocks: Indirect exposure through silver-producing companies.

- Silver Futures: Contracts to buy/sell silver at future prices (more suited for experienced traders).

- Silver ETFs: Exchange-traded funds offering silver exposure without handling physical bullion.

However, for UAE investors seeking security, control, and direct ownership, physical silver bullion remains the most trusted and tangible investment method.

Start Your Silver Investment Today

With growing demand across key sectors and silver’s strong position as a hedge against uncertainty, it is an excellent time to add silver to your portfolio.

Use Metals Radar to compare prices from trusted dealers and secure the best value for silver bars and coins in the UAE.