Investing in Gold Investment

Showing 17–25 of 25 results

For centuries, gold has been revered for its rarity, beauty, and intrinsic value, making it a sought-after asset worldwide. As a universally recognised commodity, gold not only acts as a reliable store of wealth but remains highly tradable, offering a secure and tangible investment option with long-term advantages.

Why Include Physical Gold in Your Investment Portfolio?

Owning physical gold has long been regarded as a proven method for protecting assets, diversifying investments, and securing wealth—particularly during times of economic or political instability.

Key Advantages of Physical Gold:

- Wealth Preservation:

Gold holds its value over time, unlike fiat currencies that can lose purchasing power. Its scarcity and enduring worth make it a trusted asset for long-term financial stability across generations. - Security in Times of Uncertainty:

During economic crises or geopolitical unrest, gold is viewed as a safe-haven investment. It provides protection when traditional assets falter. - Protection Against Inflation:

Historically, gold has maintained or increased its value during inflationary periods, preserving investors’ purchasing power as currencies weaken. - Portfolio Diversification:

Gold often moves independently of, or inversely to, traditional financial markets like stocks and bonds, helping reduce overall portfolio volatility. - Liquidity:

Gold, whether in bars, coins, or jewellery, remains highly liquid and easily tradable worldwide.

How to Invest in Gold

The two main methods of investing in physical gold are purchasing gold bars or gold coins. Your choice will depend on your investment goals, budget, and personal preferences.

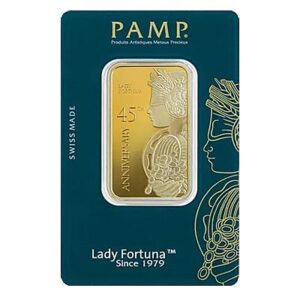

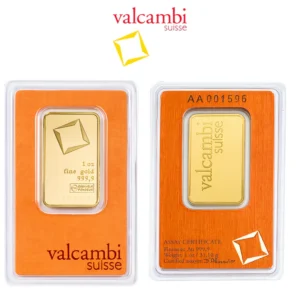

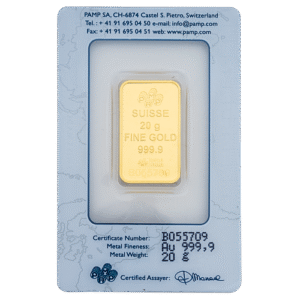

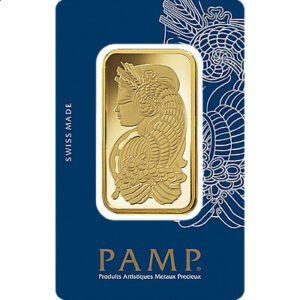

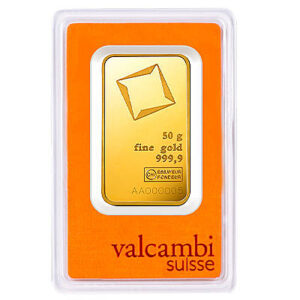

Gold Bars

Gold bars, also called ingots, are typically refined to a minimum of 99.95% purity and are available in sizes ranging from 1 gram to 400 ounces.

Smaller bars are precision-minted for a polished finish, while larger bars are cast, giving them a traditional rugged appearance.

Produced by respected names like the Perth Mint and PAMP Suisse, each gold bar is stamped with essential details: the producer’s logo, weight, and purity.

Advantages of Gold Bars:

- Lower Premiums:

Bars typically have smaller premiums over the gold spot price compared to coins. - Efficient Storage:

Their uniform shape makes stacking and storage easy. - Ideal for Larger Investments:

Best suited for those aiming to acquire significant quantities of gold efficiently.

Disadvantages of Gold Bars:

- Reduced Flexibility:

Bars cannot easily be divided, and larger bars may be harder to sell quickly.

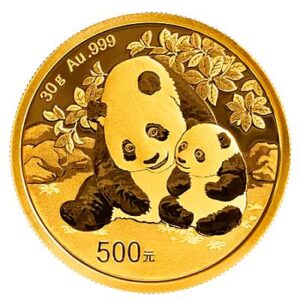

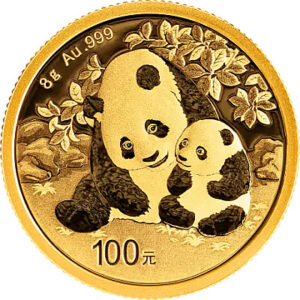

Gold Coins

Investment-grade coins like the British Gold Britannia offer high purity (typically 99.99%) and are produced by official national mints. Coins come in various sizes, allowing investors to start small and build over time.

Advantages of Gold Coins:

- Ease of Trade:

Recognisable designs make coins easy to buy, sell, and verify. - Lower Entry Cost:

Coins allow investors to start with a modest outlay. - Potential Collectible Value:

Some coins appreciate over time due to rarity, historical significance, or design.

Disadvantages of Gold Coins:

- Higher Premiums:

Coins tend to carry larger premiums than bars. - Less Practical for Bulk Investments:

Higher premiums make them less efficient for large-scale purchases.

Gold Bars vs Coins: Which Suits You Best?

- Gold Bars:

Ideal for large investments, lower premiums, and those focused on value per gram. - Gold Coins:

Better for smaller, flexible investments and those interested in potential numismatic value.

Alternative Ways to Invest in Gold

Beyond physical gold, other options include:

- Gold Jewellery:

Traditional but usually lower in purity and higher in retail premiums. - Gold ETFs:

Exchange-traded funds that track the gold price without physical ownership. - Gold Futures Contracts:

Allow investors to speculate on future gold prices without taking delivery. - Gold Mining Stocks:

Indirect exposure by investing in companies that extract gold.

While these methods offer exposure, they do not provide the full control and security of owning physical gold.

Factors Influencing Gold Prices

Gold prices are quoted in US dollars per troy ounce, and several key factors influence them:

- Global Supply and Demand:

Limited supply and shifts in industrial and investment demand affect price movements. - Currency Movements (Pound Sterling):

A weaker pound typically leads to higher gold prices in the UK. - Interest Rates:

Lower rates enhance gold’s appeal by reducing the opportunity cost of holding non-yielding assets. - Economic Conditions:

Inflation, recessions, and market uncertainty often drive investors toward gold. - Geopolitical Tensions:

Wars, political instability, and crises frequently boost gold demand.

Ready to Invest?

If you’re considering investing in physical gold, Metals Radar’s comparison tool can help you find the best prices and most reputable dealers.

Whether you choose gold bars or coins, Metals Radar ensures you make an informed and confident decision that aligns with your investment strategy.