Investing in Gold Bars

Showing all 12 results

Gold bars, often referred to as bullion or ingots, are a popular investment choice for individuals looking to secure their wealth in physical form. Produced by both private and state-run mints, these bars contain a minimum of 99.5% pure gold, ensuring they meet stringent global standards for quality and authenticity.

Available in a wide range of sizes—from 1 oz to 1 kg—gold bars offer flexibility to suit different investment goals and budgets.

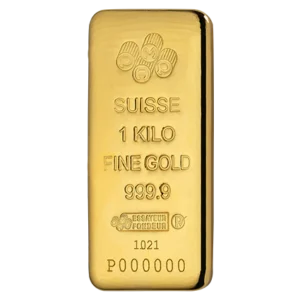

Smaller bars are usually minted with a polished finish, while larger bars are typically cast, giving them a rugged, traditional look.

This flexibility allows investors to prioritise either aesthetics or cost-effectiveness depending on their preferences.

Why Choose Gold Bars?

When weighing up investment options between gold bars and gold coins, many investors favour bars for several reasons:

- Cost Efficiency:

Gold bars usually have lower premiums over the spot price compared to coins, offering a more economical way to buy physical gold. - Compact and Convenient:

Their uniform shape makes bars easy to store, stack, and handle, ideal for efficient storage solutions. - Ideal for Larger Investments:

Investors looking to buy significant amounts of gold at once often prefer bars for their simplicity and cost advantages.

Key Benefits of Investing in Gold

Investing in gold bars offers numerous strategic advantages:

- Portfolio Diversification:

Gold’s performance often contrasts with stocks and bonds, making it an excellent hedge against market volatility. - Long-Term Wealth Preservation:

Unlike currencies that can devalue over time, gold has retained its worth for centuries. - Security During Economic Uncertainty:

Gold demand typically rises during political, financial, or economic crises. - High Liquidity:

Gold bars are easily tradable worldwide, providing flexibility when you need to liquidate. - Inflation Hedge:

As inflation erodes currency value, gold often preserves or enhances purchasing power.

Recommended Gold Bars for UK Investors

When buying gold bars, choosing reputable manufacturers is crucial to ensure quality and easy resale. Top options include:

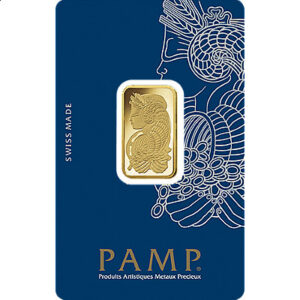

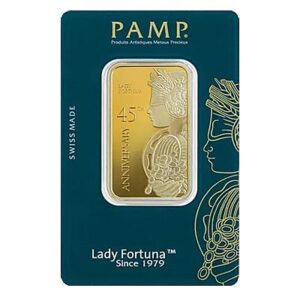

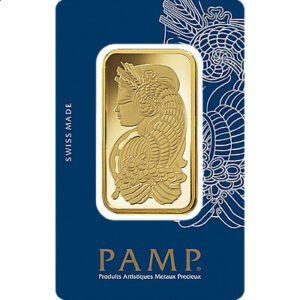

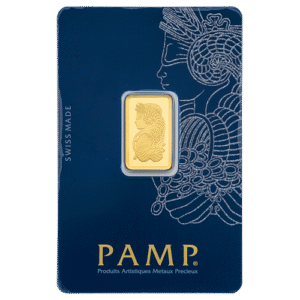

- PAMP Suisse:

Known for exquisite craftsmanship and 999.9 purity. Popular choices include the Lady Fortuna bars, Multigram® packs, and themed Lunar Legends series. - Argor-Heraeus:

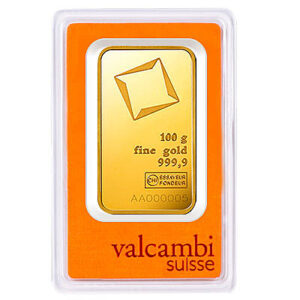

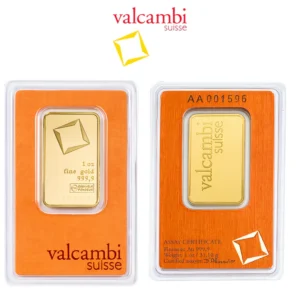

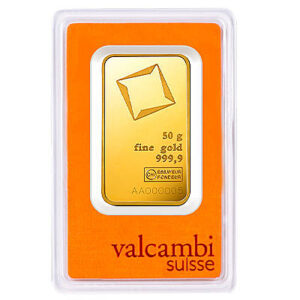

A trusted Swiss refinery offering both minted and cast bars. Their Kinebar® series features cutting-edge holographic security for added protection. - Valcambi:

One of the world’s largest refiners, famous for elegant designs and innovative products like the CombiBar®, which can be broken into smaller, flexible units. - Royal Mint:

The UK’s official mint, offering highly secure gold bars backed by government assurance—a safe and trusted choice for British investors.

Important Considerations When Purchasing Gold Bars

Before purchasing, keep these points in mind:

- Purity:

Always select bars of at least 99.5% purity—most top-quality options are 999.9 fine gold. - Size and Liquidity:

Larger bars offer lower premiums per gram but can be harder to sell quickly.

Smaller bars or divisible bars like CombiBars® may offer better liquidity. - Source and Reputation:

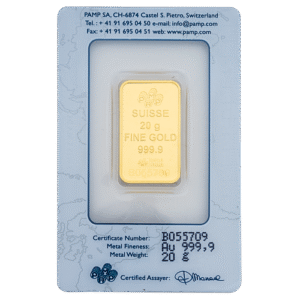

Stick to well-known refiners and mints to ensure authenticity and easy resale. - Certification and Packaging:

Genuine gold bars are packaged securely and come with a certificate of authenticity. - Price Comparison:

Gold bar prices vary slightly depending on dealer premiums and market spot price fluctuations—use a trusted comparison tool to get the best deal.

Buying Gold Bars in the UK

Investing in gold bars offers a reliable method to diversify and protect your wealth.

To maximise value, compare prices from trusted UK dealers through a reputable comparison platform.

This ensures you secure the most competitive rates without sacrificing quality or authenticity.